We offer our customers 4 standard asset management strategies:

- Speculative 2020

- Liquid Instruments 2020

- Balanced 2020

- Conservative 2020

Their main objective is to outperform the market, thanks to a combination of various instruments including Russian and foreign stocks, highly liquid ruble bonds and Eurobonds, RTS futures and the like.

Speculative 2020

Standard strategy: How it works

- In operation: since November 25, 2019.

- Investment objective: return on investment that is significantly higher than the current interest rate on a bank deposit.

- Risks: see description of associated risks of the Speculative Strategy in Annex 2 to the Managed Investment Account Agreement.

- Expected return in Russian rubles: no less than 15%.

- Expected return in US dollars or euro: no less than 12%.

- Types of assets: same investment instruments as for Conservative Strategy 2020, Balanced Strategy 2020 and Liquid Instruments Strategy 2020 plus financial derivatives, certificates and notes.

- Investment horizon: 1 year.

- Acceptable risk as a percentage of market value of assets at the start of investment period – 40%.

- Fee structure. Management fee – 1.5% of average quarterly value of assets under management (paid quarterly). Performance fee – 20% of return (paid quarterly). High watermark applicable to the performance fee.

- Other management expenses – 0.01-0.3% of assets under management. Management expenses to cover the operating costs are paid by the Investment Manager. They do not require prior approval and/or acceptance by the customer and are deducted directly from assets under management.

- There is no benchmark for this strategy.

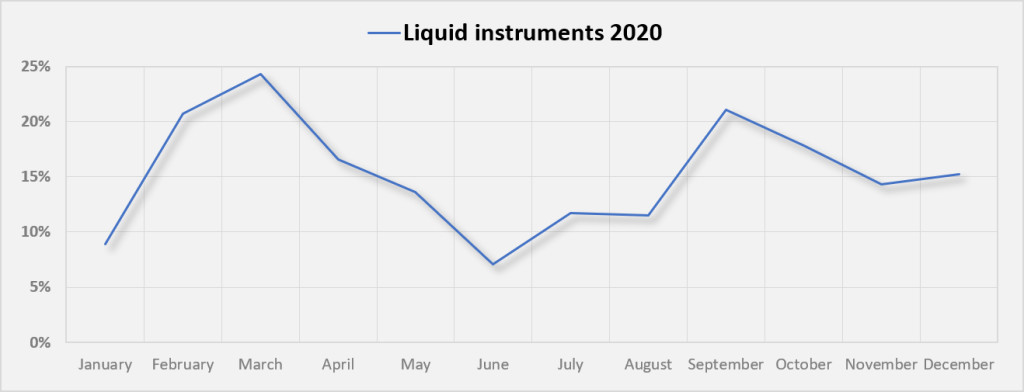

Liquid Instruments 2020

Standard strategy: How it works

- In operation: since November 25, 2019.

- Risks: see description of associated risks of the Liquid Instruments Strategy in Annex 2. to the Managed Investment Account Agreement.

- Expected return in Russian rubles: between 10% and 15% on an annual basis.

- Expected return in US dollars or euro: 6-12% on an annual basis.

- Types of assets: same investment instruments as for Conservative Strategy 2020 and Balanced Strategy 2020 which are sufficiently high liquid.

- Investment horizon: 1 year.

- Acceptable risk as a percentage of market value of assets at the start of investment period – 25%.

- Fee structure. Management fee – 1% of average quarterly value of assets under management (paid quarterly). Performance fee – 15% of return (paid quarterly). High watermark applicable to the performance fee.

- Other management expenses – 0.01-0.3% of assets under management. Management expenses to cover the operating costs are paid by the Investment Manager.

- They do not require prior approval and/or acceptance by the customer and are deducted directly from assets under management.

- There is no benchmark for this strategy.

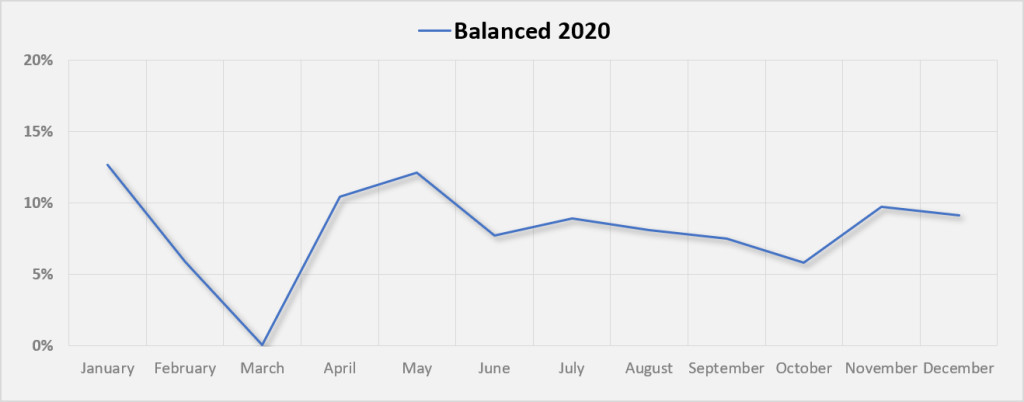

Balanced 2020

Standard strategy: How it works

- In operation: since November 25, 2019.

- Investment objective: capital preservation. Return on investment significantly higher than the current interest rate on a bank deposit.

- Risks: see description of associated risks of the Balanced Strategy in Annex 2 to the Managed Investment Account Agreement.

- Expected return in Russian rubles: 8-12% on an annual basis.

- Expected return in US dollars or euro: 5-7% on an annual basis.

- Types of assets: same investment instruments as for Conservative Strategy 2020, Balanced Strategy 2020 plus municipal bonds, bonds issued by Russian regional governments, foreign bonds, Russian depositary receipts and foreign depositary receipts, investment units of Russian unit investment funds, Russian and foreign stocks, cash and deposits in Russian banks, cash in foreign banks.

- Investment horizon: 1 year.

- Acceptable risk as a percentage of market value of assets at the start of investment period – 20%.

- Fee structure. Management fee – 0.8% of average quarterly value of assets under management (paid quarterly). Performance fee – 12% of return (paid quarterly). High watermark applicable to the performance fee.

- Other management expenses – 0.01-0.3% of assets under management. Management expenses to cover the operating costs are paid by the Investment Manager. They do not require prior approval and/or acceptance by the customer and are deducted directly from assets under management.

- There is no benchmark for this strategy.

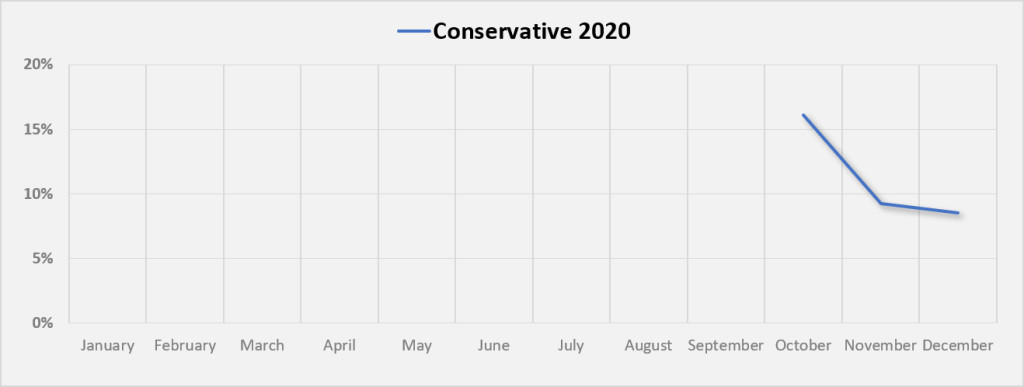

Conservative 2020

Standard strategy: How it works

- In operation: since November 25, 2019.

- Investment objective: capital preservation. Return on investment higher than the current interest rate on a bank deposit.

- Risks: see description of associated risks of the Conservative Strategy in Annex 2 to the Managed Investment Account Agreement.

- Expected return in Russian rubles: 6-10% on an annual basis.

- Expected return in US dollars or euro: 4-6% on an annual basis.

- Types of assets: same investment instruments as for Conservative Strategy 2020, Balanced Strategy 2020 plus municipal bonds, bonds issued by Russian regional governments, foreign bonds, investment units of Russian unit investment funds, Russian and foreign stocks, cash and deposits in Russian banks with international ratings no less than BB-, cash in foreign banks with international ratings no less than BB-.

- Investment horizon: 1 year.

- Acceptable risk as a percentage of market value of assets at the start of investment period – 15%.

- Fee structure. Management fee – 0.5% of average quarterly value of assets under management (paid quarterly). Performance fee – 10% of return (paid quarterly). High watermark applicable to the performance fee.

- Other management expenses – 0.01-0.3% of assets under management. Management expenses to cover the operating costs are paid by the Investment Manager. They do not require prior approval and/or acceptance by the customer and are deducted directly from assets under management.

- There is no benchmark for this strategy.